The U.S. Housing market has taken some heavy blows in the slowly mending recession, but it is not dead. People are buying and selling houses. But if you are in the buying mode, it is more important than ever that you be informed. A recent release by the Federal Reserve Board, titled “Looking for the Best Mortgage” has several key words: Prepare, Compare and Negotiate.

Determine Your Best Mortgage Payments

Start the process by an honest and realistic assessment of your ability to purchase a home. Be certain up front how much you can afford for a down payment and closing costs. Use a free mortgage calculator to determine your monthly payments. Start with your credit report. If it is less than perfect, due to illness or temporary loss of income, don’t just give up, assuming that you would be limited to high-cost lenders. If the information in the report is accurate but you have good reasons for the negatives, explain them to a potential lender or broker. If the less-than-perfect report can’t be explained, you probably will end up paying more. But don’t assume. Ask how a past credit history affects the price of a loan and what you would need to do to offset the current bad rating. You can obtain a current credit report by visiting www.annualcreditreport.com or calling 877-322-8228. Or go directly to the reporting agency. Equifax: (800) 685-1111; TransUnion: (800) 99196-8800; Experian: (888) 397-3742.

Mortgage Lending

Be ware of the types of lenders, including commercial banks, mortgage companies, thrift institutions and credit unions. Different lenders may quote you different prices. Contact several and compare. You may work through a mortgage broker, who would arrange a transaction rather than lending money directly. Remember that a broker is not obligated to find the best deal for you unless you have signed a contract. Consider contacting more than one broker, just as you do with the lending institutions. It may not be clear if you are dealing with a lender or a broker. Some institutions operate in both capacities and their advertisements likely do not use the word “broker.” Ask if a broker is involved in your potential purchase. A broker is usually paid a fee separate from and in addition to the lender’s origination and other fees. His compensation may be in the form of “points” paid at closing or as an add-on to your interest rate or both. Ask how your broker will be compensated so you can compared the various fees. Negotiate if it is appropriate.

Shop and Compare Mortgage Lenders

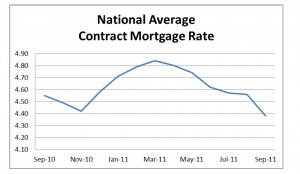

Be sure to get mortgage information from several lenders or brokers. Just the monthly payment or the interest rate is not enough. Seek information about the same loan amount, loan term and type of loan so you can compare the details. Interest rates fluctuate, sometimes several times in the same day. Even very small differences may make an impact on your payment. Ask if the rate is fixed or adjustable. If you choose an adjustable rate, keep in mind that when the rate goes up, so will your monthly payment. Get the details. Ask about the loan’s annual percentage rate, which takes into account not only the interest rate but points, broker fees and certain other credit charges, expressed as a yearly rate. Points are fees paid to the lender or broker and often are linked to the interest rate. Usually, the more points you pay, the lower the rate, to compensate for the larger amount. Your local newspaper has information about current rates and points. Ask that points be quoted as a dollar amount rather than as a number of points. A home loan is likely to involve several fees such as loan origination or underwriting, broker, transaction, settlement and closing costs. Some are negotiable. Ask. Application and appraisal fees often are required when you apply, others are paid at closing. You may be able to borrow the money to meet fees, but that will increase the loan amount and total costs. “No cost” loans may be available, bu they usually involve higher rates. Several items may be lumped into one fee. Ask questions until you understand what each fee is for.

Down Payment Requirements For Mortgages

Down payment requirements vary. They range from as little as 5 percent to 20 percent, depending on the lender’s policy. If a smaller down payment is involved, the lender may require the purchase of private mortgage insurance. Government-assisted programs such as FHA, VA or Rural Development Services generally require substantially smaller down payments. Don’t look just at the amount, be informed on all the variables.

Negotiating Your Mortgage Terms

Once you have the background information on what lenders offer, prepare to negotiate. Be aware that on any given day, lenders and brokers may offer different prices for the same loans to different customers, even if they have the same loan qualifications. Loan officers and brokers often are allowed to keep some or all of this difference as extra compensation. Such higher prices are termed ” overages.” When they occur, they are built into the prices quoted to consumers. Have the lender or broker write down all the loan’s associated costs and see if any of the elements can be waived or reduced. Be sure that one fee is not lowered while another is being raised through points. You may simply ask for better terms, quoting those more favorable that you have found elsewhere if that would be helpful. Once you feel you have done the best possible, you may want to lock in the loan. Be clear on the rate you have agreed on and how long the lock-in lasts. A fee, sometimes refundable at closing, may be charged for the lock-in. The arrangement also could backfire on you if interest rates go down while you’re waiting to close. Again, time to negotiate a compromise if possible.

Legal Protection For Home Buyers

Remember that there are laws that protect you as a potential home buyer. The Equal Credit Opportunity Act prevents discrimination based on race, color, religion, national origin, sex, marital status or age or whether any part of your income comes from a public assistance program The Fair Housing Act provides the same protections, adding handicapping conditions and familial status to the conditions that cannot be used as determinants for loans. A consumer cannot be refused a loan or charged more or offered less favorable terms because of any of the listed conditions.

For most Americans, a home is the most significant purchase they make. It is a process that should involve your best effort. Take your time. Prepare. Compare. Negotiate.

Save money by ordering cheap checks online.