The Great Recession that plagued personal finances from 1993 to 2008 had a significant impact on the amount of money Americans were saving. Savings figures for the period were at the lowest levels in recent history.

But by May of 2009, the household savings rate had climbed to 6.9 percent, the highest level since 1993. It took a major financial jolt to get people back on the right track. The effect of the recession, coming on the heels of a period of high borrowing, was a disaster for many. Bankruptcy filings had nearly doubled by the end of 2008.

If you have lingering concerns about the state of your own finances, check your data against these indicators. Make adjustments if necessary.

5 Steps To Financial Health

Credit Scores

1. Check your credit score. In a range of 300 to 850, the higher your score, the better your financial health. Lenders use this score to determine if they want to do business with you. To get a credit score without cost, contact one of the three primary credit bureaus, TransUnion, Equifax or Experian. If your score is below 600, try to improve it by paying down debt, satisfying outstanding judgments or curb your use of credit cards.

Savings

2. If you are saving less than 5 percent of your income, it isn’t enough. In 1993, the rate, at 7 percent, was the highest it had been. Since then, too many earners began dipping into savings to see them through the recession, rather than adding to their savings cushion. The trend now is up and if you haven’t joined the savers, now is the time. Don’t look at it as an immediate thing, but as part of the retirement you hope to have. If your savings backup is niggardly, it may disappear entirely in the event of a medical emergency or any other of the many financial challenges that can bite when you aren’t prepared. Make savings of 10 percent of income a goal.

Credit Cards

3. You can be pretty sure you are in over your head if you carry credit card balances from month to month or if you are paying only a small amount to the principal. This is a major cause of financial stress for many people. Ideally, you use a credit card only in emergencies, or charge only what you can pay off in a month. Then you start whittling away at the total, paying whatever you can over the expected monthly payment. Only $5,000 in credit card debt requires a minimum $200 a month and can ultimately cost $8,000, taking up to 13 years to pay off.

Mortgages

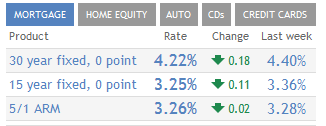

4. If housing consumes more than 28 percent of your income, you are in trouble. Almost certainly you will have to cut back in other areas of your budget to handle that load. When the housing market was thriving, the mortgage lenders were allowing people to buy homes that absorbed up to 35 percent of their income, but with the country just coming out of the housing slump, they are edging back to the 28 percent figure. Give some serious thought to downsizing if possible.

Cut Back

5. If your non-housing bills are going crazy, you can assume you need to do something to restore balance. Succumbing to the temptation to buy items on time, you end up paying what seem to be relatively small amounts on a dozen or more products or services. Then relative small quickly becomes over-large and you’re suddenly in the category in which the required outgo is larger than the income. Assess your situation by putting all the bills on the table and seriously discussing them. Identify what you can trim or do without and then do without it. Just one for-instance: Do you really need a 500-channel cable TV package if you are using only a few of the channels? Do you really need a land line if you have cell phones? Etc. etc. etc. An honest look may help your family regain control of its resources without any really painful sacrifices.

Do what you can to avoid become part of the dismal foreclosure and bankruptcy statistics. Keep tabs on your finances and move toward a better distribution of what you have for the sake of the future as well as the present.