Credit Reports

Check to see if you have a credit report. You could have established credit without being aware of it. For instance, if you have been authorized to use a family member’s credit, you might have a credit report. It is also possible that you have been a victim of identity theft, and that definitely needs to be cleared up before you start building credit in earnest. WalletHub is one site that offers credit reports and scores that are updated daily. If you find a report under your Social Security number, analyze it and if necessary, dispute errors, fraudulent accounts and negative records related to unauthorized use.

Get A Credit Card

Starting with a clean slate, open a starting credit card. It is usually pretty easy. There are some that don’t charge an annual fee or require you to incur debt as loans do. They report to the major credit bureaus on a monthly basis.

Three options for a starter card include student credit cards, general use cards for people with limited credit and secured credit cards. You have to have an active college or university email address to get a student credit card. A secured card offers the best opportunity to get guaranteed approval without the risk of overspending. The alternative to a starter card is a loan, usually for home, car, student use or other need that requires debt with interest.

Use Your Credit Card For 6 Months

Use the card responsibly for at least six months. That will generate a credit report and score. The score could range from bad to well above average, depending on what you did with the card and how well you paid. This first report is critical, because it puts you under the credit score microscope. Mistakes will be magnified beyond what they would be if you were a seasoned credit user.

Pay Bills On Time

Pay each month’s bill on time and keep your utilization of the card below 30 percent – 10 percent for the best result. Never use all the credit they extend to you. Setting up automatic payments from a deposit account is helpful in meeting these standards. Responsible handling of the initial card will help when you are ready to apply for a higher credit limit.

Study Your Credit Report

When you have a sense of how your initial foray into credit card use went, continue to study your credit report regularly. By looking at all of the components of the report, you can gain a sense of how the system works and be prepared for long-term credit use. You can learn to adjust course if any element of your report seems out of sync.

A responsible journey into the world of credit can set you up for life in what is an important element in ongoing personal finance.

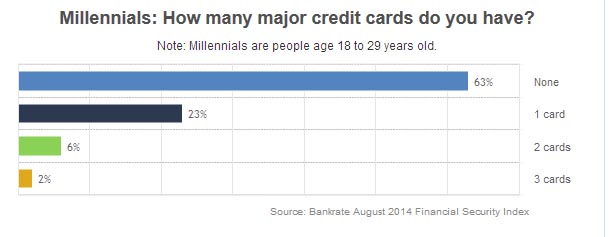

Who would ever guess that being without credit cards could be a problem? Too many people know the stress of having to make the payments that credit cards require, but not having any cards can create difficulties of another kind. Borrowing in the future may be hampered if you haven’t built a history of bill-paying.

Who would ever guess that being without credit cards could be a problem? Too many people know the stress of having to make the payments that credit cards require, but not having any cards can create difficulties of another kind. Borrowing in the future may be hampered if you haven’t built a history of bill-paying.