Who would ever guess that being without credit cards could be a problem? Too many people know the stress of having to make the payments that credit cards require, but not having any cards can create difficulties of another kind. Borrowing in the future may be hampered if you haven’t built a history of bill-paying.

Who would ever guess that being without credit cards could be a problem? Too many people know the stress of having to make the payments that credit cards require, but not having any cards can create difficulties of another kind. Borrowing in the future may be hampered if you haven’t built a history of bill-paying.

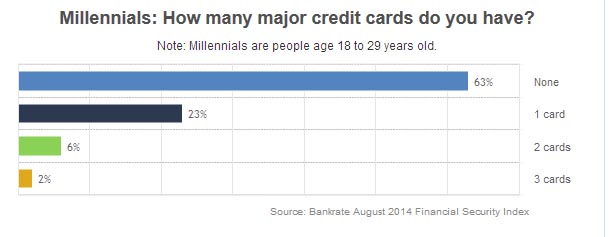

The millennials who are now in their working years tend to take on fewer credit cards than did their older peers. But when you apply for a loan, for a car or house, say, the potential creditor will be looking for evidence that they can expect you will pay regularly and on time.

Avoid becoming part of the “credit invisible” group by looking ahead and planning when and how to use a credit card. Before 2009, when Congress passed the Credit Card Act, college students were sent offers from banks and other financial institutions for credit cards, usually with a glut of “goodies” to sweeten the deal. Under the act, persons under 21 must have a co-signer or be able to prove income to obtain a card.

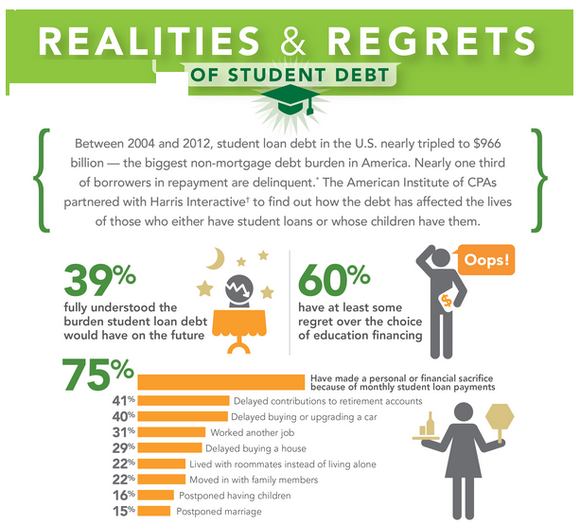

The provisions had a dampening effect on applications for cards by young people. NerdWallet did a survey that determined 31 percent of those in the 19-34 age bracket had never applied for a card. Millennials, too, have been deluged with horror stories of the results of uncontrolled debt and may be more wary of taking on cards than those who preceded them. Those born at the turn of the century were becoming job-eligible after a serious recession had turned the country’s economy topsy-turvy. The increasing costs of student loans also have had an effect on the overall financial thinking of the millennials.

But the reality comes home to roost when credit is a sensible part of personal finances. Not being able to get loans – or even to set up a cellphone plan – brings the role of credit into stark reality. Sometimes, even a large down payment on a big-ticket item may not offset the creditor’s inability to verify a customer’s credit standing.

Delaying too long also may complicate your ability to obtain a card when you want one. A disproportionate number of those in the millennial age group were denied credit cards on their first application, according to Fair Isaac Corp. research. Because they haven’t built a credit record, they end up with low scores, the average being 628 – not enough to impress the card issuers. Banks often require a good to excellent rating to issue a card. Being denied a card multiplies the problems, as the denial becomes part of the credit rating.

Being persuaded to apply for a card because of the flashy perks such as cash-back rewards, airline miles, etc., may look good at first glance, but the institutions that offer such incentives often charge more interest, or even an annual fee. Don’t jump too fast.

Piggy-backing, or adding your name to the card owned by a parent or other relative may be an option. But be certain that the individual has a good credit rating, or it may ultimately affect your own rating. Likewise, you are more likely to have your feet held to the fire so that your lapses in payment don’t affect the card owner’s credit.

A secured card may be the answer for your first-time foray into credit. These cards require money in a security deposit account as collateral. Income and ability to pay also must be proved. This type of card helps to build a credit history that may lead to other cards after time. Prepaid cards do not build a credit record, simply tapping into deposited funds.

Consider the options and go for the one that fits your needs. But some sort of credit card will ultimately work to your benefit as you get into the serious business of life as an adult.

Related Articles

Millenials Say No To Credit Cards