• Perfect credit is required. Not so. Having a higher credit score is helpful and may get you a lower interest rate, but it is not the only factor a lender considers when you come to borrow money for your home. If you can show that you are able to repay a loan you probably can swing the loan if your credit score is above 670.

• Rising interest will prevent your owning a home. Rising interest rates do, as a matter of fact, affect how much of a loan you can qualify for and the kind of loan you might be offered, but it doesn’t mean you are out of the market. CoreLogic projections show that an 0.85 percent increase in interest will cost the buyer another $100 per month. That may seem like a lot, but it is less than the period of all-time high interest rates in the early 1980s, when a fixed 30-year mortgage rate was at 18 percent.

• You need a 20 percent down payment. Conventional home loans may make this requirement, but there are other options. FHA loans require only 3.5 percent down. VA loans may be financed for up to 100 percent of the price. Lending institutions often have provisions for loans with a minimal amount down, say $1,000. The downside of a small down payment is that you may be required to buy private mortgage insurance.

• Prequalification means you have the loan. Going through a prequalification process determines how much mortgage you can afford by computing your income and liabilities, but it is not a binding agreement. The potential lender will look at additional documentation before you are fully approved.

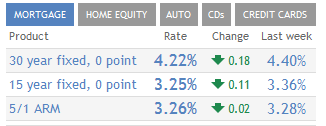

• A 30-year mortgage is best. It’s the most popular option, but not the only one. A 15- or 20-year loan can save a lot in interest payments. An adjustable rate mortgage starts with a fixed rate then is adjusted according to market factors. That means your payment will fluctuate over time.

Don’t compare mortgage options based on their advertised rates, but look at their annual percentage rate, which lenders are required to advertise, along with mortgage interest rates. The APR includes estimated fees and other charges, giving you a more accurate picture of what you can expect.