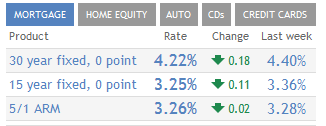

Anyone who has ever ventured into the world of home buying has learned something about the interest rates that are an integral part of the deal. They yo-yo up and down almost daily. In early May, they hit the lowest level they have been for awhile, at 4.21 percent for a 30-year fixed rate house loan. That was a decline from 4.29 percent the previous week. For a 15-year loan the rate 3.32 percent, a drop from the 3.38 percent of the previous week. The 15-year option is popular for those refinancing existing mortgages.

Anyone who has ever ventured into the world of home buying has learned something about the interest rates that are an integral part of the deal. They yo-yo up and down almost daily. In early May, they hit the lowest level they have been for awhile, at 4.21 percent for a 30-year fixed rate house loan. That was a decline from 4.29 percent the previous week. For a 15-year loan the rate 3.32 percent, a drop from the 3.38 percent of the previous week. The 15-year option is popular for those refinancing existing mortgages.

These rates were the lowest since last November.

The question for most lay folk not privy to the ups and downs of the housing market, the question is: What causes the swings? Why do they rise and fall so consistently and so fast?

Believe it or not, such things as global unrest and a weak U.S. economic recovery from the recent recession are major factors. What happens in Africa and Russia and China sends shock waves into the American economy and affects transactions at the most basic levels. The old saying that it’s a small world is especially true when it comes to the fluctuations in the American housing market.

Negative economic effects in other places on the globe contribute to the ongoing bid for Treasury debt, which drives yields down, with a subsequent dip in mortgage rates as well, financial gurus say. That’s good news for those in the market for a home. The practical effect is a lower house payment. For instance, on a $200,000 home with a 30-year fixed rate mortgage, the monthly payment would be $979 a month at rate of 4.21 percent. At the norm of 6 percent, the home buyer could expect to shell out about $1,200 per month. Though the fractional increases or decreases in the interest rate seem negligible, they make a big difference when you’re making a long-term loan.

There are, of course, other factors at play. Stricter lending standards have to some extent limited the impact of the lower interest rates, according to data compiled by the National Association of Realtors. A high credit score can even the effect. But for those with lower scores, credit is still very tight, the association reports. Many of those who would like to jump into the housing market can’t find financing, despite the attraction of a lower interest rate.

The best solution for those whose credit is marginal is to work on improving the credit score to make themselves more appealing to those who made loan decisions.