Could a little infusion of omega-3 fatty acids into your next helping of steak or hamburger make the meal more healthful? It’s the same thing that salmon naturally consume with their algae and it’s what walnuts contain in abundance, health experts say.

Could a little infusion of omega-3 fatty acids into your next helping of steak or hamburger make the meal more healthful? It’s the same thing that salmon naturally consume with their algae and it’s what walnuts contain in abundance, health experts say.

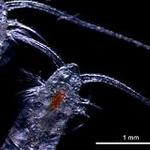

Some ranchers are experimenting with feeding their cattle flaxseed and marine algae to enhance the products they send to market. And researchers at Kansas State University are testing the products to see if they actually retain any health benefits from the added fats in their diets.

Texas food stores that sells the omega-3-enhanced meats reported that sales quadrupled over a seven-month period. And a national study suggests that consumers would be willing to pay $1.85 more per pound for enriched steaks and 79 cents more per pound of enhanced hamburger.

The movement runs counter to current wisdom that advises less beef in the diet. But in a country that consumes mountains of fast foods, many of them containing beef, maybe the health angle carries more weight. Nutrition experts say that people should consume at least 250 mg per day of the fatty acids eicosapentaenoic and docosahexaenoic acids of the type that are contained in algae. Adding them to beef might encourage that level of consumption.

Adding algae and/or flaxseed to the diets of meat cattle increases the omega-3 content in their meat to at lest 200 mg per 5-ounce serving, compared with 20- to 30-mg in the meat of grass-fed cattle.

Salmon remains the best source of omega-3, providing 10 times the amount contained in enriched beef products – at least 2,000 mg in a 5-ounce serving.

Cost becomes a factor with omega-3 enhanced beef. Commercial sources of algae are not readily available. However, the costs of feeding cattle flaxseed to increase omega-3 content is offset because the animals tend to be healthier and need fewer antibiotics, those experimenting with the enhanced meat products say. And test sales in some markets suggest that consumers like the additional marbling, tenderness and flavors in the meat. They come back for more, preferring them over the grass-fed products that may be a little cheaper.

Other omega-3-rich products such as eggs, salmon and walnuts, also are attracting more consumers, particularly among the health-conscious. That may encourage sales for the enhanced beef products. Time will prove if there is a place in the popular market and whether the enhanced meats will find a permanent niche in the American diet.