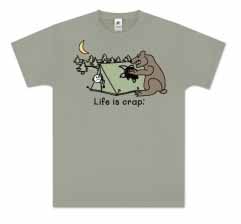

Everyone who is actually inhaling and exhaling on a regular basis knows it. Life is crap. Sometimes, despite our best efforts, we end up in the soup. Anyone over two has already learned to expect the unexpected. (Actually, it starts long before you reach two, but Mom takes care of it. It’s part of her crappy life.)

So, what’s a person to do? Paul Wheeler believes the only answer is laughter. The whole focus of his company — predictably named Life is Crap — is to take the inevitable, put it up front and visible and laugh it off. “It’s our mission,” says Wheeler of his Manchester, Vt., company. Together with his partner, Ken Lefevre, they have successful brought the company to the marketplace.

“Everything we do revolves around the idea that crap happens and that laughter is the cure.”

That means the message shows up on T-shirts, caps —anywhere an individual can make a statement on the way things are in this troubled world. The company is now expanding into cheap checks that give folks a frequent opportunity to reflect on the vagaries of life and apply their sense of humor. “We’ve seen what works, now we’re scaling up. We’re always looking for ways to expand.” Always within the boundaries of the basic concept, he adds. That careful attention to sticking to initial principles has turned Life is Crap into a $10 million dollar enterprise.

If you ended up with a bad split in the bowling alley, there it is—a shirt showing the ball rolling easily between the two widely separated pins. Out of wine? Lament the fact with a public display of the empty glass. The bicycle depicted crashing into the pile of dirt at the bottom of the hill? It has happened to all of us. Wheeler and crew simply take the universal hazards of everyday living and put them out there where everyone can laugh along. The company customizes such items as magnets, books, calendars, shirt, caps, towels, hoodies, key rings, shot glasses, beer steins, decals, greeting cards, page a day calendars items— any desired surface that will accommodate an image.

Looking at the irritations of life might seem like a negative approach, but those who retail his products don’t seem to mind, Wheeler has found. No one has ever complained. Of course, that means finding the best outlets for Life is Crap merchandise. Someone lacking the sense of humor to appreciate the products, obviously, isn’t the one to present them to his purchasing public, Wheeler has found. The bah-humbuggers who refuse to find humor in life are to be avoided. And there are, believe it or not, some “crap” areas that don’t translate well to the buying public.

There have been some bombs along the learning curve. The company thought that politics was a logical target for its kind of humor and found that, in fact, no serious person of any political persuasion wanted anyone publicly poking fun at their well-known areas of crap. That venture was a failed effort that cost time and money, he said.

Another spot too sensitive to subject it to humor, the company found, is the current economy. No merchant wanted his customers reminded that times are tough. The popular idea of what’s funny changes with time and events, Life is Crap has found, but there is always plenty of grist for its mill in just the ongoing, everlasting irritations that humans endure. The company expects to continue to thrive on items that make the enduring easier.

The whole road to success, Wheeler said, has been a process of trial and error. When the group started, they were up against the same basic questions each new small business faces. How to put their ideas into concrete products. How to find the best business model to meet their goals. How to allocate the existing resources most effectively. Where to find the most effective market outlets. They spent a year in development.

To date, the company has developed some 500 images, licensed them and marketed through over 1100 stores. As the small business got a toe hold in the market, the next logical step was putting the goods online, he said. “We buy back product from the manufacturer and sell it online. We’ve done well and have seen it grow. Now we are focused on getting traffic to our site.”

The basic concept for Life is Crap requires employees who are in tune, he said. The group is small—just five employees—but they comprise the gamut of artistic and business savvy that is making Life is Crap a growing concern. Being constantly alert to possibilities has contributed to the growing of the company’s product lines. Pure serendipity, in fact, had a hand in bringing designer checks into the fold. Wheeler, et al, met the owner of Carousel Checks during a trade show. There was an exchange of ideas and voila! Another licensing arrangement was born.

In 2012, the company will be focused in building and expanding our direct to consumer internet business. New products to be launched include several other related sub-brands: Life is Poop — for infants, Life is Ruff for dog lovers, Old Life is Crap for Senior Citizens, College Life is Crap for College Students and Life is Beer — for BEER LOVERS.

The fact that life is crappy is not likely to end soon. There is always the bird overhead looking for a place to unload. That bodes well for Wheeler and Life is Crap as they look for new targets for their brand of humor.