$1.2 Million More

The Federal Bank of New York recently released a report confirming the value of higher education. Those who earn a bachelor’s degree can expect to earn about $1.2 million more during the usual work years — ages 22 to 64 — than their peers who stop short of that educational milestone.

Even those with an associate’s degree are expected to outstrip their non-degreed friends by some $325,000 over their work lives, reported the study, which was based on U.S. Census Bureau and Bureau of Labor data.

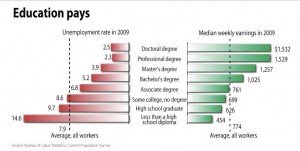

The college-educated have lower unemployment rates and are less likely to live in poverty, the statistics showed.

Between 1970 and 2013, those with a bachelor’s degree earned on average about $64,500 per year; those with an associate’s degree about $50,000; and those with a high school diploma about $41,000 per year.

The higher earnings tend to more than offset the costs of higher education, the report indicated. A bachelor’s degree, after subtracting tax benefits and financial aid awards, cost an average $122,000 in 2013. The cost for an associate’s degree in the same year was $43,700. Most college students also lose the income they could have earned while they are studying.

More Earning Power

Even so, college graduates have more earning power than their less-educated peers, according to data gathered by the Bureau of Labor Statistics and the College Board. Most employers, even if they provide only basic employment, will pay more for workers with any level of post-high school education.

In an Associated Press report on the New York study, the example of recent college graduate Katie-Beth Vornberger, age 24, was cited. She graduated in May from George Mason University, taking away with her some $20,000 in debt. She had worked part-time to help cover her tuition. She was immediately employed by a consulting firm that manages social media accounts at a salary $4 per hour more than she was earning while in school. She hopes for a full-time job with the firm and has expectations that her higher education will soon begin paying off.

Though it has always been clear that there are avenues besides college that lead to valuable job preparation, the statistics continue to affirm that some formal training, including trade schools and on-the-job experience, will lead to more earnings over a lifetime.