The costs rose about 6 percent a year from 2002 to 2012, about three times the rate of overall inflation, the Government Accountability Office reported. One of the reasons is the frequent issuing of new textbooks with little new material. Many texts also include workbooks and other supporting materials that boost the cost.

In 2008, the Higher Education Opportunity Act was passed, requiring publishers to inform college faculty about the content of textbooks along with pricing. Schools also are required to list a textbook’s price and the ISBN (International Standard Book Number) in course registration materials. The information is expected to help students to make decision as to whether they should buy new or used or rent a text.

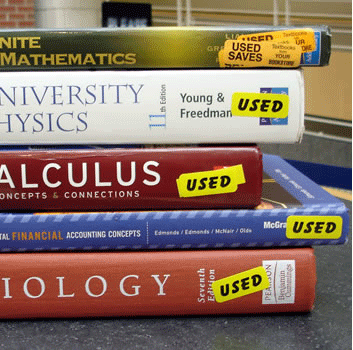

There are some options that reduce the costs for students who are textbook shopping:

Armed with the ISBN, you can shop online. Punch in the numeric code and you can do some comparison shopping. One for-instance: college freshmen required to have “Campbell Biology” for their classwork will find the new copies selling at $241. But a used copy often will be available in the neighborhood of $181. Use comparison pricing websites to find even better deals – as low as $30 per copy. Remember that shipping times and fees will vary. Not all online dealers have refund policies. And not all used book have the CDs or electronic codes that access course content online. You’d have to buy them separately.

It is possible to rent textbooks, either from online retailers or college bookstores. Most of the 3,000 members of the National Association of College Stores now offer rentals. Most rental agreements are for an entire term, including the final exam period. The renter is required to keep the items in good repair and it may not be possible to jot notes in the margin as you might do with your own property. Renting has the advantage of not having to resell or store the book. The renter will tack on fees if you are late returning the text, and the supplementary materials that are assigned with many textbooks would have to be arranged for separately.

Many assignments can be read online. Consider an e-text. Digital books can also be rented at a fraction of the cost of buying a new textbook. There is no need for a dedicated reader. You can access the materials on most devices. Most have tools that assist you in highlighting and taking notes. Most young students today are comfortable with this kind of learning, but for those who didn’t grow up with computers, there may be a period of adjusting.