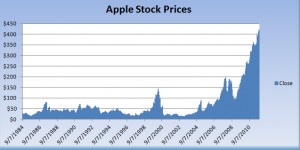

What does the future of Apple look like without Steve Jobs? Analysts are predicting a very bright future.

Today, Apple is worth $377.83 billion dollars. Share prices are fluctuating between $401 – $409. It is the largest company in the world and new products are in development. The iTV, which is currently in the prototype stage, could revolutionize the television industry and it could add billions of dollars to the worth of Apple.

Gene Munster, analyst for Piper Jaffray, a $400 million dollar investment company, says “We believe that of the estimated 220 million flat panel TVs sold in 2012, 48% or 106 million units will be internet-connected, of which Apple could sell 1.4 million units,” Munster wrote. “We believe an Apple Television could add $2.5 billion or 2% to revenue in 2012, $4.0 billion or 3% in 2013 and $6.0 billion in 2014.”

Will that make investing in Apple now a good investment? David Zeiler writes an interesting article: Why Apple Stock Is Headed for $500 – And Beyond. The momentum behind Apple seems to be growing past the loss of it’s founder, Steve Jobs.

A recent book called “Steve Jobs,” by Walter Isaacson, clearly reveals the thinking that has been driving the success of the company for years. Steve’s out of the box, creative thinking has gotten the masses to use computers in a new way. From the launch of the MacIntosh in 1984, to the recent launch of the Ipad2, his products provided us with the next generation of technology.

Designing products with ease of use has been Steve Job’s philosophy. Thank goodness, because the masses are not tech geeks. His artistic sense of design, minimalistic lifestyle and obsessive attention to detail are the fuel behind the products we have come to love and use daily.

From his high school part-time job working at Hewlett-Packard, Steve Jobs found one mentor after the next to teach him about technology, product creating, business structure and relationships. Although not always the best at relationships, his demand for perfection and his drive for great product creation triumphed.

There is a future for Apple because of Steve Jobs. His vision and creative thinking will truly be missed, but his contributions to the world will benefit generation after generation.

Related Company Valuations – October 31, 2011

| Apple Inc. | 377.68B |

| Microsoft Corporation | 225.50B |

| IBM | 218.78B |

| Google Inc. | 193.01B |

| Oracle Corporation | 166.52B |

| Intel Corporation | 129.99B |

| Verizon Communications… | 105.09B |

| Amazon.com, Inc. | 97.32B |

| Hewlett-Packard Company | 53.35B |

| Dell Inc. | 29.15B |

1984 Launch of the Macintosh

Coolchecks.net, the best place to order checks.