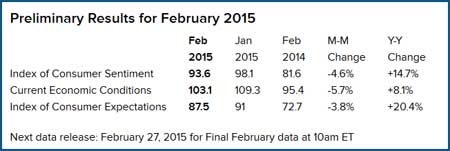

The CSI is an important measure that Investors, retailers and economists use to help determine what they will do next. When people are feeling good about the economy, the index rises and the economy gets a boost. Between 2005 and 2014, the monthly index averaged 77.1. The reading for December 2014 was 93.6 and the January 2015 reading was 98.1. Since July of 2014, the index has improved by 20 percent. Economists are encouraged by the fact that that the confidence level rose in households with income under $75,000, as well as in those with higher incomes.

At the root of the improved confidence levels are signs that the effects of the Great Recession are beginning to wane. Higher employment rates, small increases in wages and lower gasoline prices are among the factors.

Economic prognosticators, however, remain cautious, predicting that the gains will be slow, if steady. Most workers are expecting only modest gains in income over the next five years, so spending increases also will be moderate. Shoppers are likely to look for big price discounts before they will be convinced to buy, and that contributes to dis-inflationary pressure, the experts say.

Despite the cautious approach to predictions for this year, the signs all indicate that the country is regaining its economic equilibrium.