Debit cards are used by millions of people in this era. A debit card is another method of payment instead of using cash when purchasing something. It is a plastic card that is also called a check card or bank card. Having a debit card is like having a credit card minus the credit line. It is a great way of managing your money because you make sure that the things you purchase do no exceed to the amount you have in your bank. Many people regard a debit card as just another way to pay for a purchase.

Opting for a debit card is very easy. You don’t have to worry about your low credit report because the providers don’t check your record. It means everyone gets approved. Go to your bank and ask for an application. Fill out the application form and deposit funds into your deposit account. There are no extra payments involve in this process. After a week, your card will be delivered to you by mail along with a PIN needed for setting up and activating your debit card. A telephone number is included in the mail and you will have to call that number to answer some questions. After the call, type in the PIN and your debit card is activated.

Owning a debit card is very convenient for eliminate the need to write checks and show any identification. A person can freely use the card almost everywhere in many areas around the world. On the other hand, debit cards help you to control your excessive shopping habit because you can’t spend more than the amount in your account. It takes out a lot of tiresome jobs of paperwork to keep tracking your bills. Most importantly, using a debit card to shop on the Internet is the safest for you because it won’t expose your bank details, thus, preventing theft.

On the contrary, there is a risk involved in having debit cards. When your card gets into the wrong hands, expect that they can drain your bank account. Remember that a PIN code is not needed when using debit cards to transact a business. Avoid this problem by keeping your card in a very safe place always. Keeping and hiding your debit card receipts is very helpful to prevent thieves from gathering information through them. If your card is either lost or stolen, report this immediately to your

banking institution.

Debit cards are offered through Mastercard or Visa and these can be used anywhere. They are readily available in ATM’s, POS (Point of sale) terminals, and online as well as over the phone. Debit card registers can be used to record your spending, just like you would use your check register.

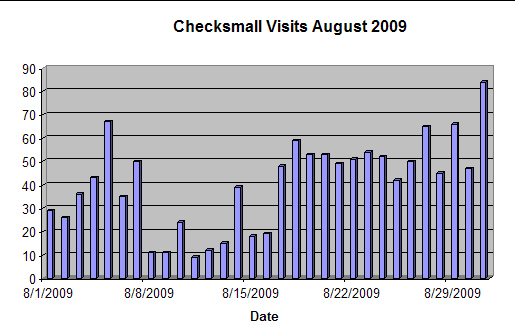

Launching a new website is not as easy as some would have you think. This is the last article in a series of articles that covered the promotional strategies of the first 30 days in the launching of a new website. Time will help any new website get more traffic and this site is so new that it will have to go through some growing pains for the next four months. Patience is needed to develop and get these new sites to a profitable stage.

Launching a new website is not as easy as some would have you think. This is the last article in a series of articles that covered the promotional strategies of the first 30 days in the launching of a new website. Time will help any new website get more traffic and this site is so new that it will have to go through some growing pains for the next four months. Patience is needed to develop and get these new sites to a profitable stage.