Getting into financial difficulties is never fun, but it happens to many people. A job loss, a health problem, and numerous other issues can be going on in your life that contribute to these problems. During these times, you’ll need to have good money management strategies in place to help you get through the storm.

1 – No Debt No Matter What

Never believe that a little debt is o.k. even though it may seem manageable at the time. Debt is like cancer. It’s not life threatening at first because it’s small and only involves a few cells. Over time though it can rapidly multiply until it takes over. You become a slave to your debt. It rules your life.

2 – Avoid cosigning on a loan

No matter how easy this can be, you’ll be better off if you don’t do this. Think of the worst case scenario and that is how you may suffer. Don’t loan others money. You are not helping them by letting them avoid responsibility for themselves.

3 – Learn About Financial Products

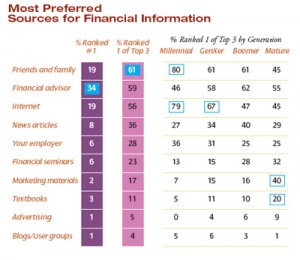

Prudential Financial did a study about women and finances. Three quarters of the 1,088 women interviewed feel they need help in making financial decisions. Two thirds of the Baby Boomers are behind when it comes to saving for retirement. Six in ten women prefer learning about financial products through family and friends. Women who get a good financial advisor, find extra help in getting on the right track to preparing for retirement.

4 – Avoid Impulse Buying

If you are tempted to purchase things that you hadn’t planned on, give yourself some time to think about the purchase, especially if it is a large purchase. Go home and think about it overnight. You’ll make better buying choices.

5 – Avoid The Sales Rationale

Some people purchase things just because they are on sale. They tell themselves that they are saving money. If you buy a $500 item on sale for $400 you aren’t saving $100 if you didn’t need it in the first place. You are just spending $400 unnecessarily. This rationale can happen at any level of spending, whether it’s a $10 item or a $1,000 item.

If you find that you are experiencing any of these danger signals, do something different today.

Danger Signals To Watch For

- Is an increasing percentage of your income going to pay off debts?

- Are you near or at the limit on your lines of credit?

- Do you worry a lot about money?

- Are you tapping your savings to pay current bills?

- Is your savings inadequate or nonexistent?

- Do you put off medical or dental visits because you can afford them?

- Are you working overtime to make ends meet?

- Has your car been repossessed?

- Are you unsure about how much you owe?

Your financial future is up to you. What you do with your time and money is going to affect you and everyone who depends on you. Use the resources available to you to help you make better financial decisions.

An investment in knowledge pays the best interest. ~ Benjamin Franklin