Ever wonder what happens to a check after you pass it on to a merchant, family member, utility or whatever?

What happens depends to a large extent on who receives it, with different routes if it is handed to an individual vs. a business. Though some businesses and individuals still deposit checks with a financial institution in person, most are processed electronically, economic experts report.

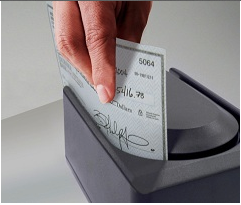

Electronically Processed Through Scanning Devices

The checks are fed through a scanning device that takes pictures front and back. The image, along with metadata and account number, is then forwarded to the paying bank. Today’s scanners are designed with optical character recognition that reads the information on the bottom of the check and the handwritten or printed amount of the payment. Even small scanners can process about 45 checks per minute. Larger ones handle hundreds or even thousands in the same time frame.

For such a small piece of paper, a check contains a significant amount of information, at least nine pieces of data in most cases. They include the date on which it is written, the recipient, the amount of payment in both figures and words, a memo to specify what it is intended for, which is optional, your signature, the routing number, checking account number and the number of this single check.

The line of information at the bottom of the check includes numbers and symbols that give the bank routing and transit numbers, the customer account information and individual check numbers. In the business, it is known as the MICR line, an acronym for “magnetic ink character readable.”

Smart Phone Apps

Many smartphones have apps that can turn a paper check into an electronic image. They take pictures, via the phone camera, front and back of the check, and transmit the pictures to the bank when the check is deposited.

When a bank receives the image, the check can be processed or cleared, through the Federal Reserve Bank’s national clearinghouse, a regional clearinghouse or a direct connection between two financial institutions.

The number of checks processed in this manner has increased significantly. In 2006, 43 percent of them were scanned and electronically handled. By 2012, the figure was almost 100 percent.

What If You Lack Sufficient Funds To Back The Check?

It will be processed, again electronically, and returned to the back on which it was written. More than 127 million “bouncers” were returned to the bank of origin in 2006. Again, by 2012, the number had fallen by almost half, with just 66.4 million returned unpaid.

Although electronic banking will likely continue to make inroads into check transactions, it’s still a great way to handle your money affairs.